Can A 2025 Nol Be Carried Back. Moreover, nols could reduce taxable income to zero in the carryback or carry forward. You probably already checked this, but just in case you didn't think about it.

You can get your refund faster by using form 1045, but you have a shorter time to file it. An nol from a taxable year.

Can a C corporation Carryback NOL’s? Universal CPA Review, As budget 2025 nears, nris look forward to reforms aiming at simplifying tds compliance, enhancing dtaa benefits, easing the repatriation process, expanding investment.

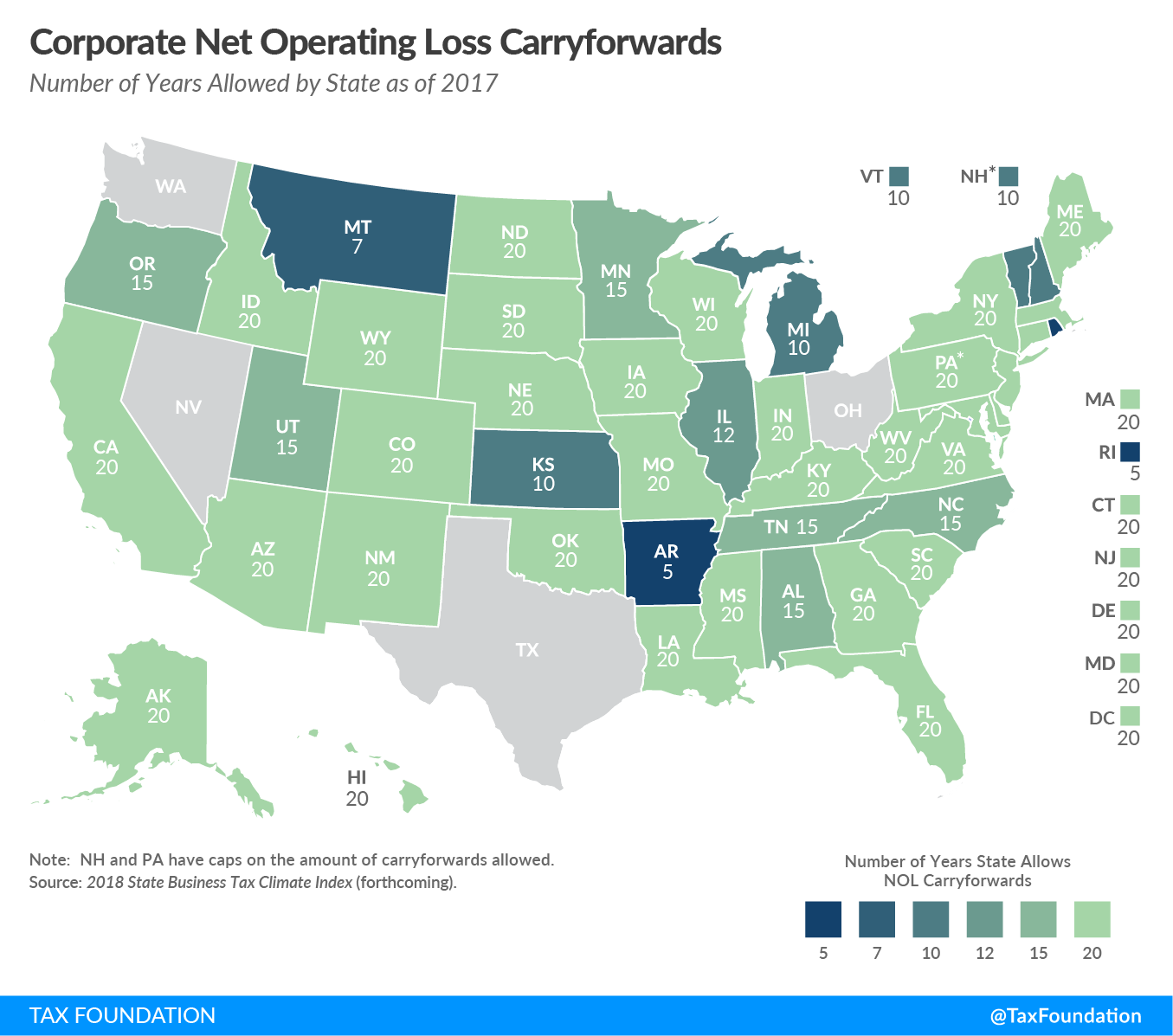

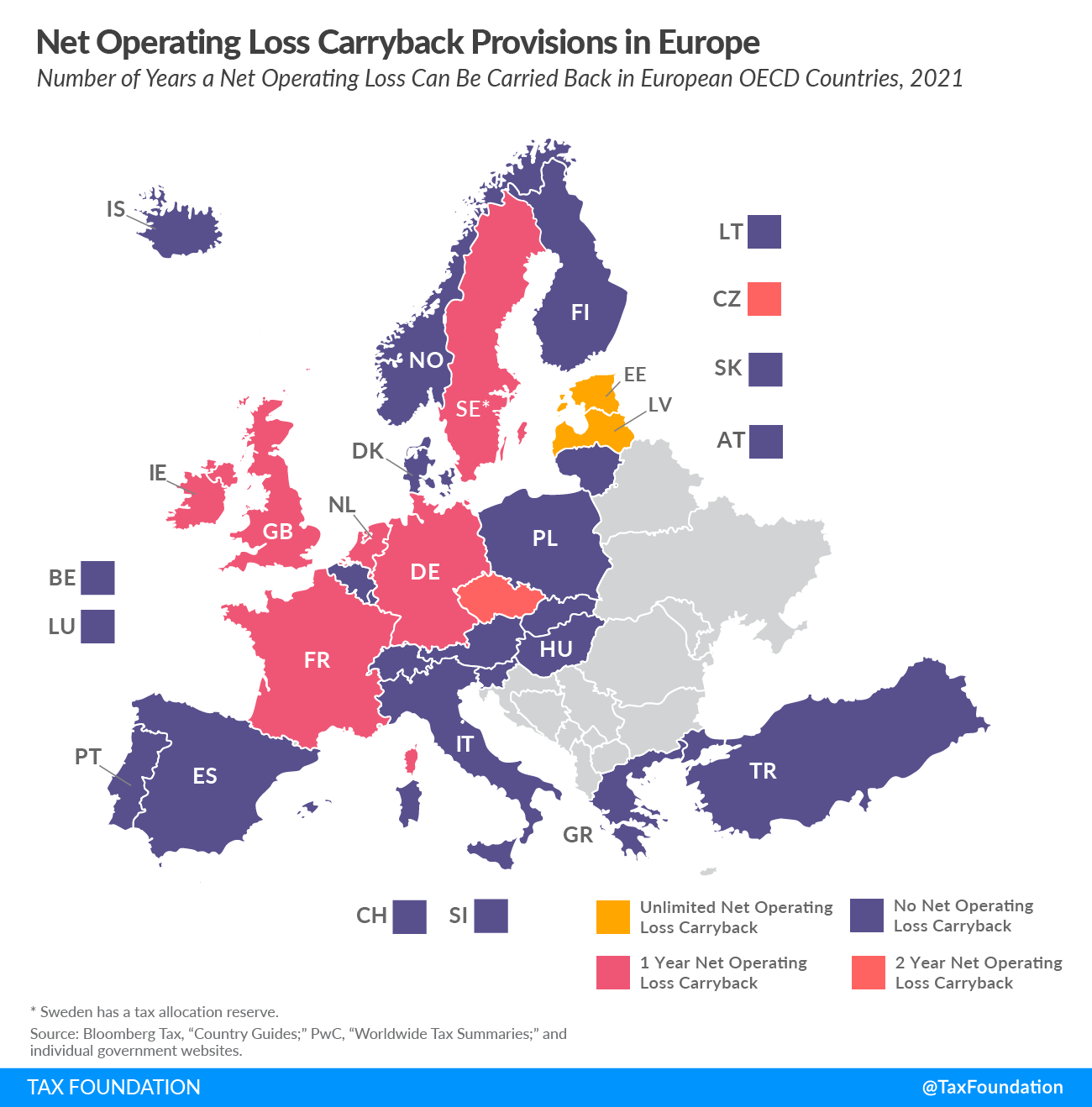

Net Operating Loss Carryforward & Carryback Provisions by State, Nols could generally be carried back two years, and then carried forward 20 years.

Can a C corporation Carryback NOL’s? Universal CPA Review, How net operating losses (nols) can be deducted from taxable income, including how to calculate the nol and how it can be carried back or carried forward to other taxable years.

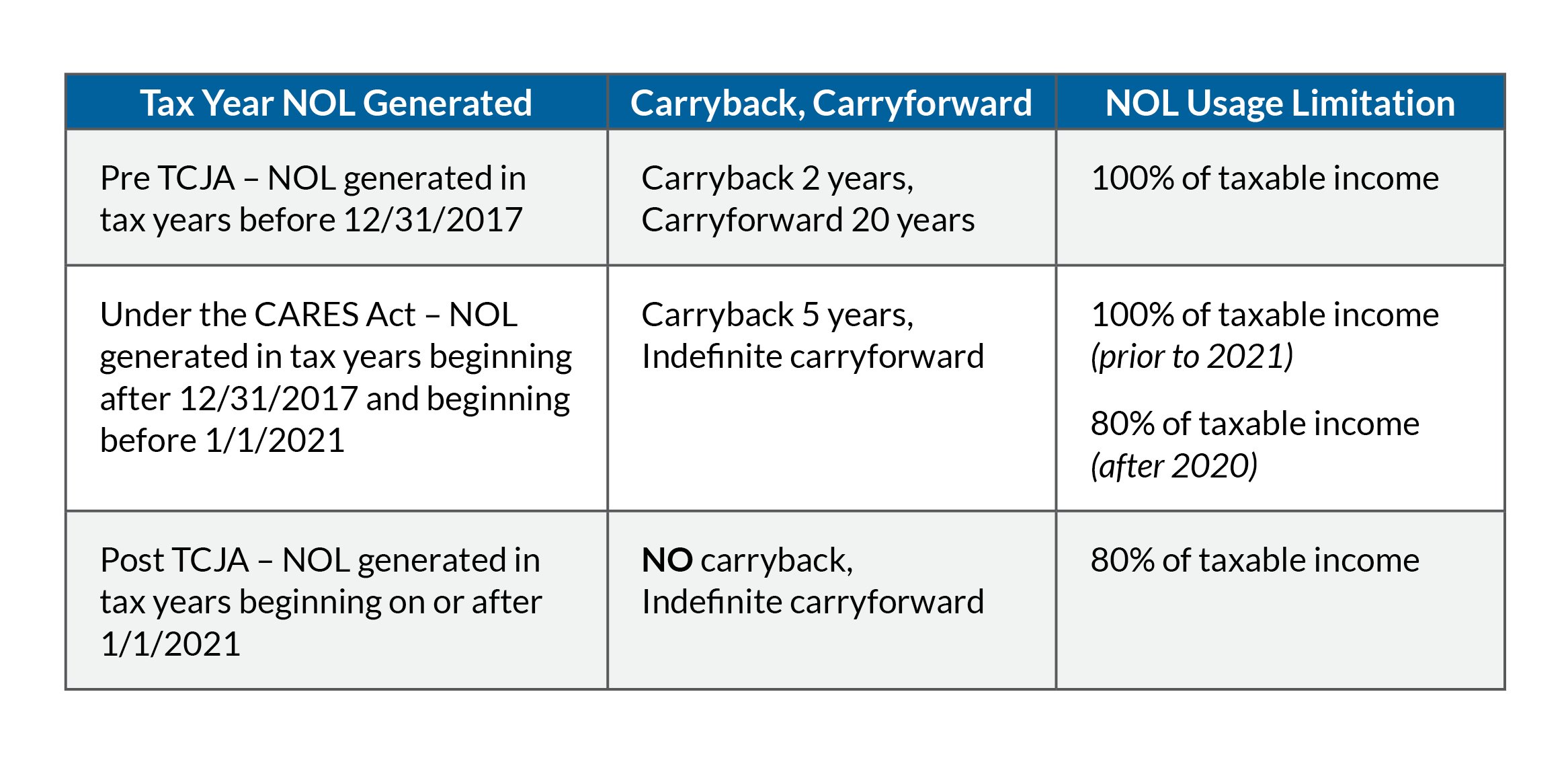

NOL Carryback Rule C.A.R.E.S NOL Carryback Provision, Net operating losses in 2025 or later may not be carried back and must be carried forward indefinitely.

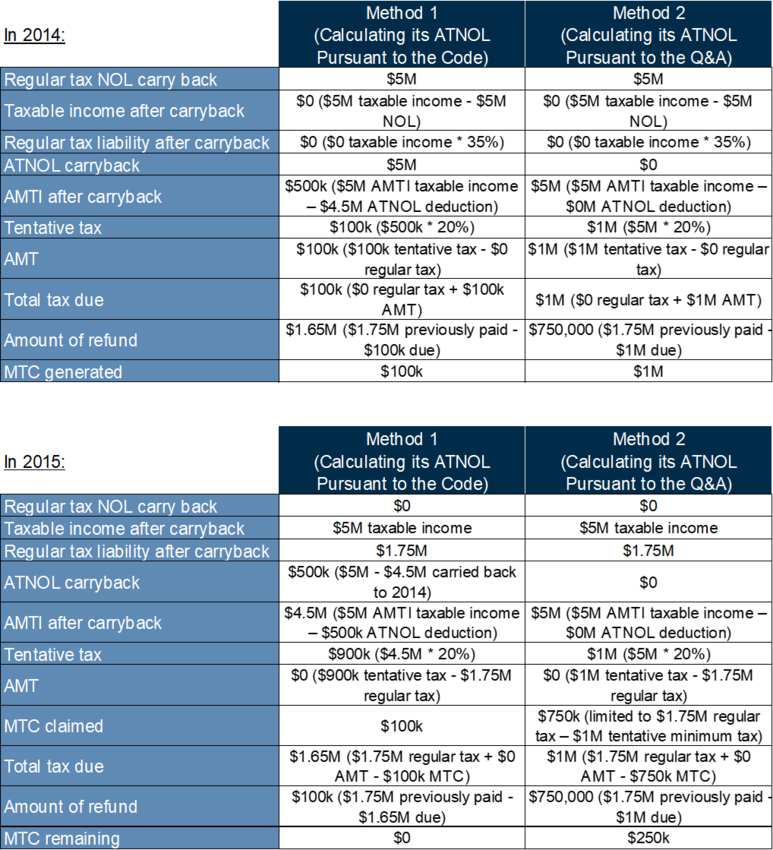

IRS Issues New NonBinding Guidance on NOL Carrybacks Alvarez & Marsal Management Consulting, Nols could generally be carried back two years, and then carried forward 20 years.

CARES Act International Tax Implications of NOL Rule Changes RKL LLP, If you have an nol, the nol can be carried over to future tax years.

Net Operating Loss (NOL) Tax Provisions in Europe Tax Foundation, For example, if you earned $100,000 in taxable income in 2025 and incurred a $20,000 nol in 2025, carrying it back could lead to a partial refund of the taxes paid in 2025.

Importance of NOL Carryback and What It Means to Businesses Harold "Hap" May, P.C. Attorneys, For example, an nol from a taxable year beginning in 2017 can generally be carried back 2 years, but can only be carried forward 20 years.

Taxation of Corporations ppt download, Before the implementation of the tcja in 2018, nols could be carried forward for up to 20 years and carried back for two years for an immediate tax refund;

Net Operating Loss (NOL) Tax Benefits and Calculation Guide, How net operating losses (nols) can be deducted from taxable income, including how to calculate the nol and how it can be carried back or carried forward to other taxable years.